Last year’s Comic-Con installation for Mr. Robot took us on a journey through a Mr. Robot storefront and then into the room (and mind) of Elliot Alderson, played by Rami Malek. This year, we stopped by to see what they had in store (pun intended) to prepare us for Season 3, which starts in October. For starters, we were greeted by not one but three storefronts, all familiar to fans of the show.

First was a shuttered Mr. Robot store. The door was littered with graffiti and flyers, all relevant to the world of Mr. Robot. The second was a branch of the Bank of E, complete with branded pens, pads of paper and monitors on the wall, displaying ads for opening loans, savings accounts, etc. Prominently placed at the back were two teller windows staffed by bank employees who were happy to help you open an eCoin account.

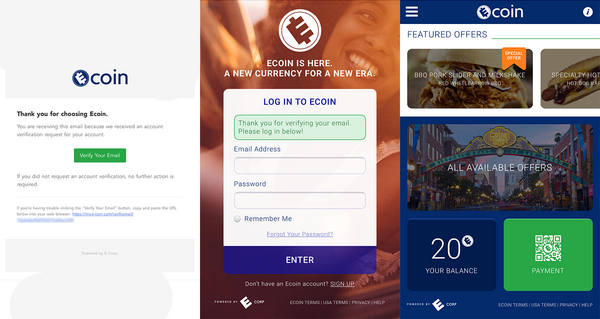

After opening an eCoin account—i.e., creating a login for their website—and verifying your email, you were presented with Bank of E branded items, including a new eCard which came pre-loaded with 20 credits. The physical or digital eCard could then be used (for 5 credits each) at more than 20 real-life establishments around the downtown San Diego area, including the third installation, a Red Wheelbarrow BBQ location.

As with many other aspects of Mr. Robot, fans were also treated to an Easter egg of sorts. Those brilliant enough to unlock the puzzle earned a special prize.

Since it appears eCoin will play a significant role in the upcoming season, we asked ESET security researchers to discuss the implications of shifting to virtual currency.

“These forms of currency are very volatile,” said Lysa Myers. “Old-fashioned currency tends to have certain stabilizing factors that keep things fairly stationary. History has shown any real-life sudden change to currency or stock values would generally not be a good time for most folks.”

Aryeh Goretsky added, “Unlike having your money in a traditional bank or financial institution, which have had decades to develop sophisticated theft and fraud checks, many of these new financial systems are only as secure as the device running them, which can often mean little to no security.”

Will we see a shift toward virtual currency over the next 30 years? Perhaps, but some aren’t even convinced the latest “chip and PIN” technology is a step forward for security. In the past, we’ve presented tips for safely using virtual currencies like Bitcoin, but even some prominent members of that community are skeptical.

Meanwhile, a Bank of E representative said extensive security measures had been taken to assure eCards (and partner vendors) were protected from outside meddling. “Once you say something is unhackable, someone is sure to take that as a challenge. I can assure the public their money is safe with Bank of E.”